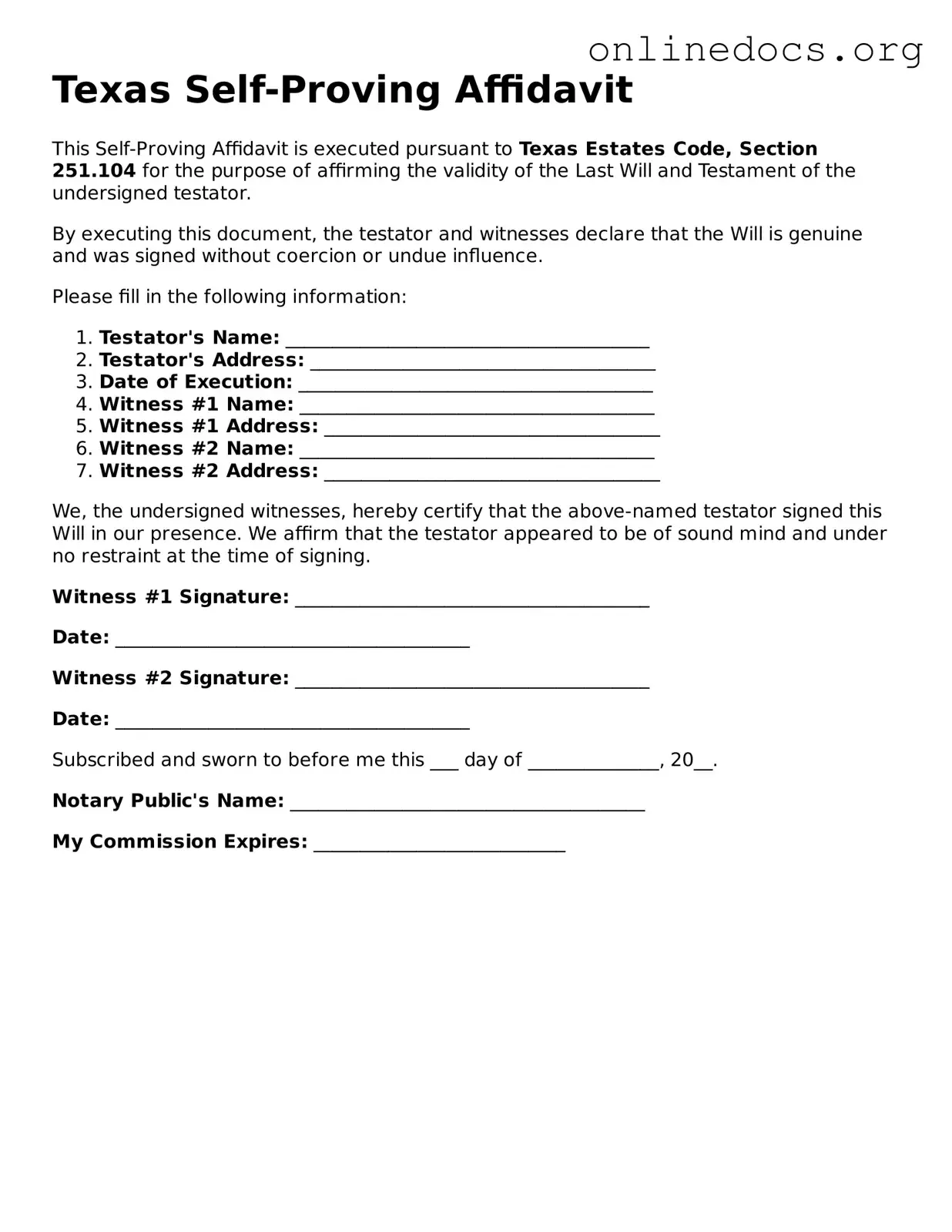

Filling out the Texas Self-Proving Affidavit form can be a straightforward process, but many people make common mistakes that can lead to complications later on. One frequent error is failing to include all necessary signatures. The form requires the signatures of the testator (the person making the will) and two witnesses. Omitting any of these can invalidate the affidavit.

Another mistake often made is not having the witnesses present at the same time when signing the document. In Texas, all parties involved must sign the affidavit in the presence of each other. If the witnesses sign separately, the affidavit may not hold up in court.

Many individuals also overlook the importance of the date on the form. Forgetting to date the affidavit can create confusion regarding when the document was executed. This can be particularly problematic if there are questions about the validity of the will or if there are disputes among heirs.

Some people mistakenly think that the Self-Proving Affidavit is optional. In reality, while it is not required, it significantly simplifies the probate process. Without it, the witnesses may need to testify in court, which can prolong the proceedings and create unnecessary complications.

Another common error is using outdated forms. Laws can change, and using an old version of the affidavit may result in noncompliance with current legal standards. Always ensure that you are using the most recent version of the form available.

Additionally, individuals sometimes fail to provide accurate information about the witnesses. Each witness must be at least 14 years old and should not be a beneficiary of the will. Listing someone who does not meet these criteria can invalidate the affidavit.

In some cases, people do not properly understand the purpose of the Self-Proving Affidavit. It serves to establish the validity of the will without requiring the witnesses to appear in court. Misunderstanding this function can lead to unnecessary complications during the probate process.

Finally, individuals often neglect to keep a copy of the completed affidavit with their important documents. It is crucial to store it alongside the will so that it can be easily accessed when needed. Failing to do so can lead to confusion and delays when the time comes to probate the will.