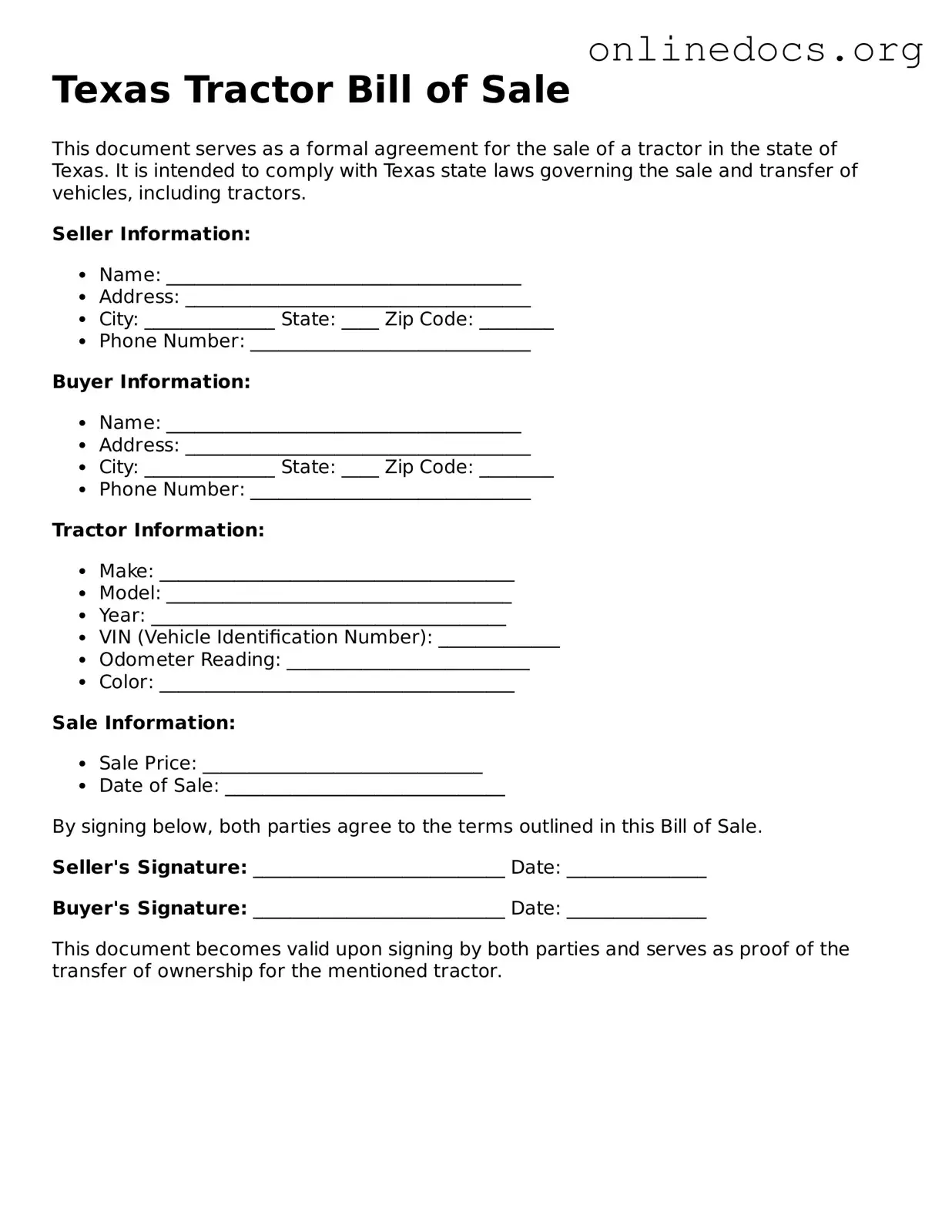

Filling out a Texas Tractor Bill of Sale form can seem straightforward, but many people overlook key details that can lead to complications down the road. One common mistake is failing to provide accurate information about the tractor itself. The form requires specific details such as the make, model, year, and Vehicle Identification Number (VIN). Omitting or incorrectly entering this information can create confusion and may even affect the legality of the sale.

Another frequent error is neglecting to include the sale price. This detail is essential not only for the transaction but also for tax purposes. If the price is missing or incorrect, both the buyer and seller may face issues when it comes time to register the tractor or file taxes. Always double-check that the sale price is clearly stated and matches any agreed-upon amount.

People often forget to sign the form. Both the buyer and seller must provide their signatures to validate the transaction. A missing signature can render the bill of sale ineffective, which could lead to disputes later on. Make it a habit to review the document for signatures before finalizing the sale.

Another mistake is not providing contact information for both parties. Including names, addresses, and phone numbers is crucial for future communication. If any issues arise after the sale, having this information readily available can save time and prevent misunderstandings.

Some individuals mistakenly believe that a bill of sale is only necessary for high-value transactions. In reality, a bill of sale is important for any sale, regardless of the price. It serves as proof of ownership transfer and can be vital in case of disputes. Always treat the bill of sale as an essential part of the transaction.

Additionally, people sometimes fail to keep a copy of the completed form. After the sale, both parties should retain a copy for their records. This documentation can be invaluable if questions arise about the transaction in the future. Keeping a copy ensures that both parties have access to the same information.

Lastly, many forget to check for any local regulations or requirements that may apply. While the Texas Tractor Bill of Sale form is a standard document, local laws can vary. It's wise to research any additional paperwork or requirements specific to your area. Taking this extra step can help avoid unnecessary complications.