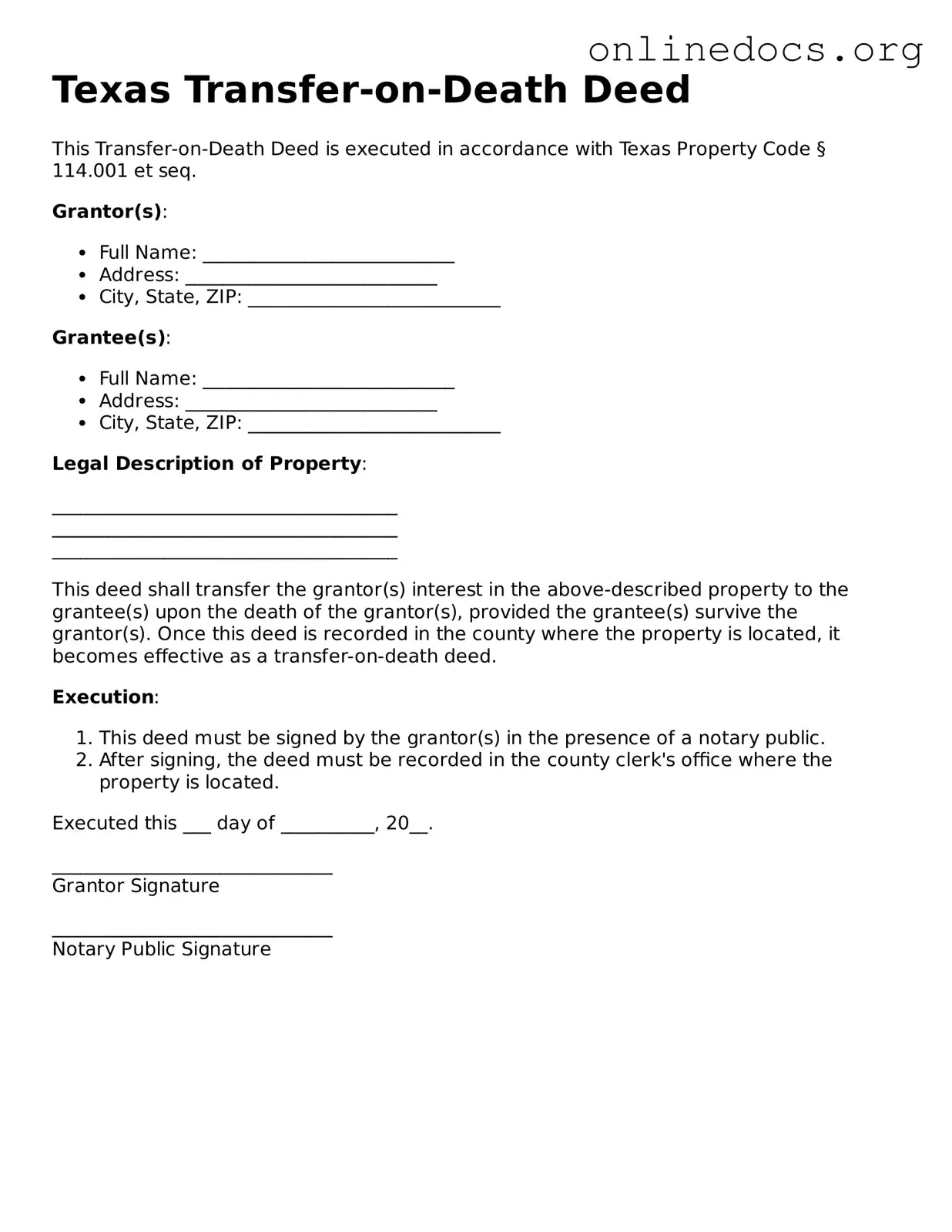

Filling out a Transfer-on-Death Deed form in Texas can seem straightforward, but many people stumble along the way. One common mistake is not properly identifying the property. The deed must clearly describe the property being transferred. If the description is vague or incomplete, it can lead to confusion or disputes later. Always ensure that the legal description matches what is found in the property records.

Another frequent error involves the names of the beneficiaries. It’s essential to provide the full names of the individuals who will inherit the property. Omitting a middle name or using a nickname can create complications. Additionally, if multiple beneficiaries are involved, it’s crucial to specify how the property will be divided. Will it be shared equally, or does one person receive a larger share? Clarity is key.

People often overlook the importance of signing the deed correctly. A Transfer-on-Death Deed must be signed by the property owner, and it must be notarized. Failing to have the deed notarized can render it invalid. Make sure to double-check that all signatures are in place before proceeding to the next step.

Another common pitfall is neglecting to file the deed with the county clerk’s office. Just filling out the form isn’t enough. The deed must be recorded in the appropriate county where the property is located. If it’s not filed, the intended transfer may not be recognized, leading to potential legal issues down the road.

People sometimes forget to consider the implications of the deed on their estate planning. A Transfer-on-Death Deed bypasses probate, but it can still affect other aspects of an estate. For example, if the property is subject to debts, those obligations may still need to be addressed. Consulting with an estate planning professional can help clarify these matters.

Another mistake is failing to update the deed after significant life changes. Marriages, divorces, or the birth of children can all impact who should inherit the property. If the deed isn’t updated to reflect these changes, it may not align with the owner’s current wishes, leading to unintended consequences.

Lastly, people often underestimate the importance of discussing the transfer with the beneficiaries. Open communication can prevent misunderstandings and ensure that everyone is on the same page. Discussing the intent behind the deed can foster family harmony and reduce the likelihood of disputes in the future.