Filling out a Transfer-on-Death Deed (TOD Deed) can be a straightforward process, but many individuals make common mistakes that can lead to complications down the road. Understanding these pitfalls can help ensure that the deed serves its intended purpose: to transfer property upon death without the need for probate.

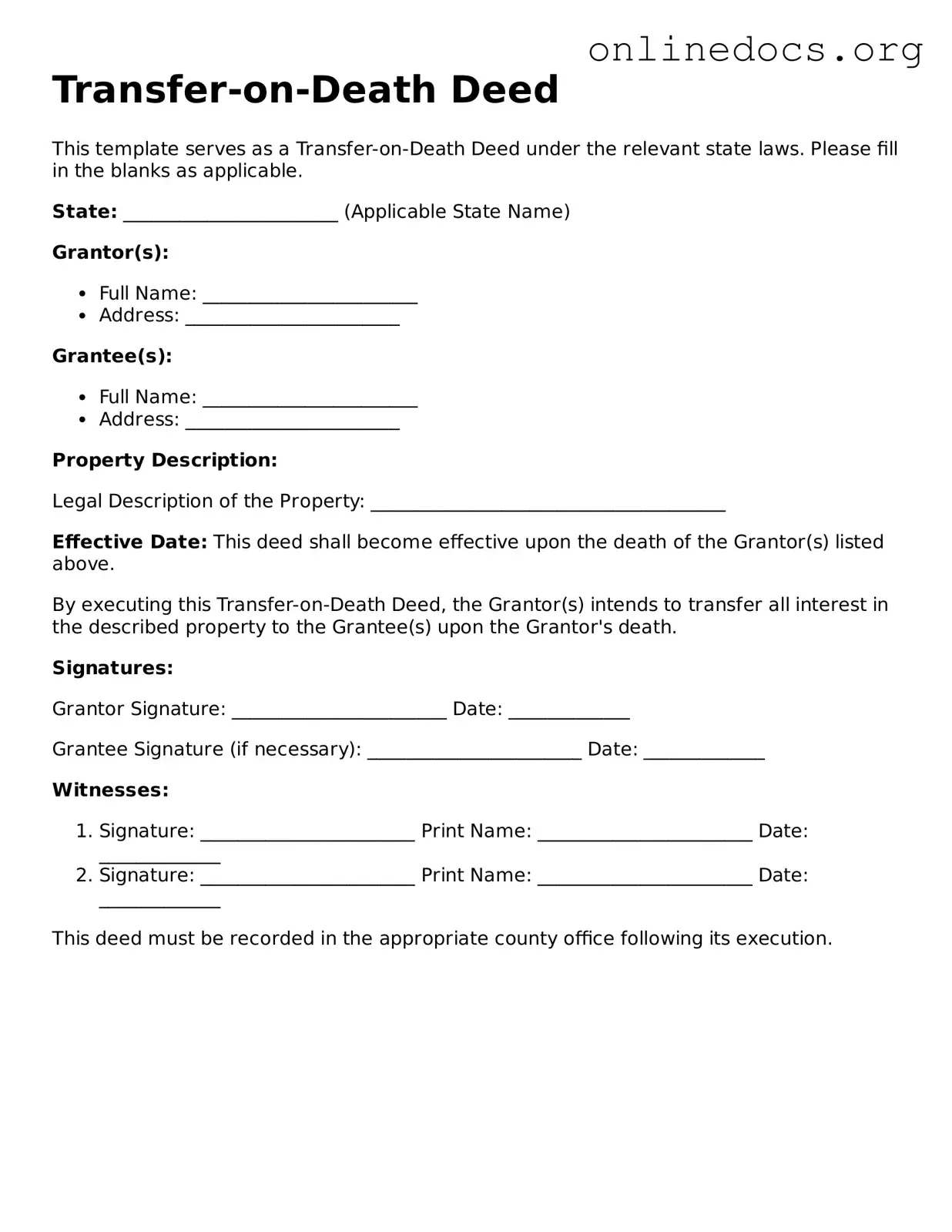

One frequent mistake is failing to include all necessary information. The deed requires specific details about the property and the individuals involved. Omitting critical information, such as the legal description of the property or the full names of the beneficiaries, can render the deed ineffective. It’s essential to double-check that all required fields are filled out accurately.

Another common error involves not properly signing the deed. Each state has its own requirements regarding who must sign the deed and how it should be executed. In many cases, the deed must be signed in front of a notary public. Failing to follow these requirements can invalidate the document, leading to unwanted legal complications.

People often forget to record the deed after it has been signed and notarized. Simply filling out the deed is not enough; it must be filed with the appropriate county office to be legally recognized. Without this step, the deed may not be enforceable, and the property could still go through probate.

Another mistake is designating the wrong beneficiaries. It’s crucial to clearly identify who will inherit the property. Misunderstandings can arise if beneficiaries are not specified correctly, particularly if there are multiple individuals with similar names. To avoid confusion, use full legal names and consider including their relationship to the property owner.

Some individuals also overlook the importance of updating the deed when life circumstances change. Events such as marriage, divorce, or the death of a beneficiary can necessitate changes to the deed. Failing to make these updates can lead to disputes or unintended consequences regarding the transfer of property.

Additionally, not consulting a professional can be a significant misstep. While it may seem straightforward, the nuances of property law can be complex. Seeking guidance from an attorney or a qualified professional can help ensure that the deed is completed correctly and in accordance with state laws.

Lastly, individuals sometimes neglect to inform beneficiaries about the existence of the TOD Deed. Communication is key. Beneficiaries should be aware that they are designated to receive the property, as this can prevent confusion and disputes among family members after the property owner’s passing.