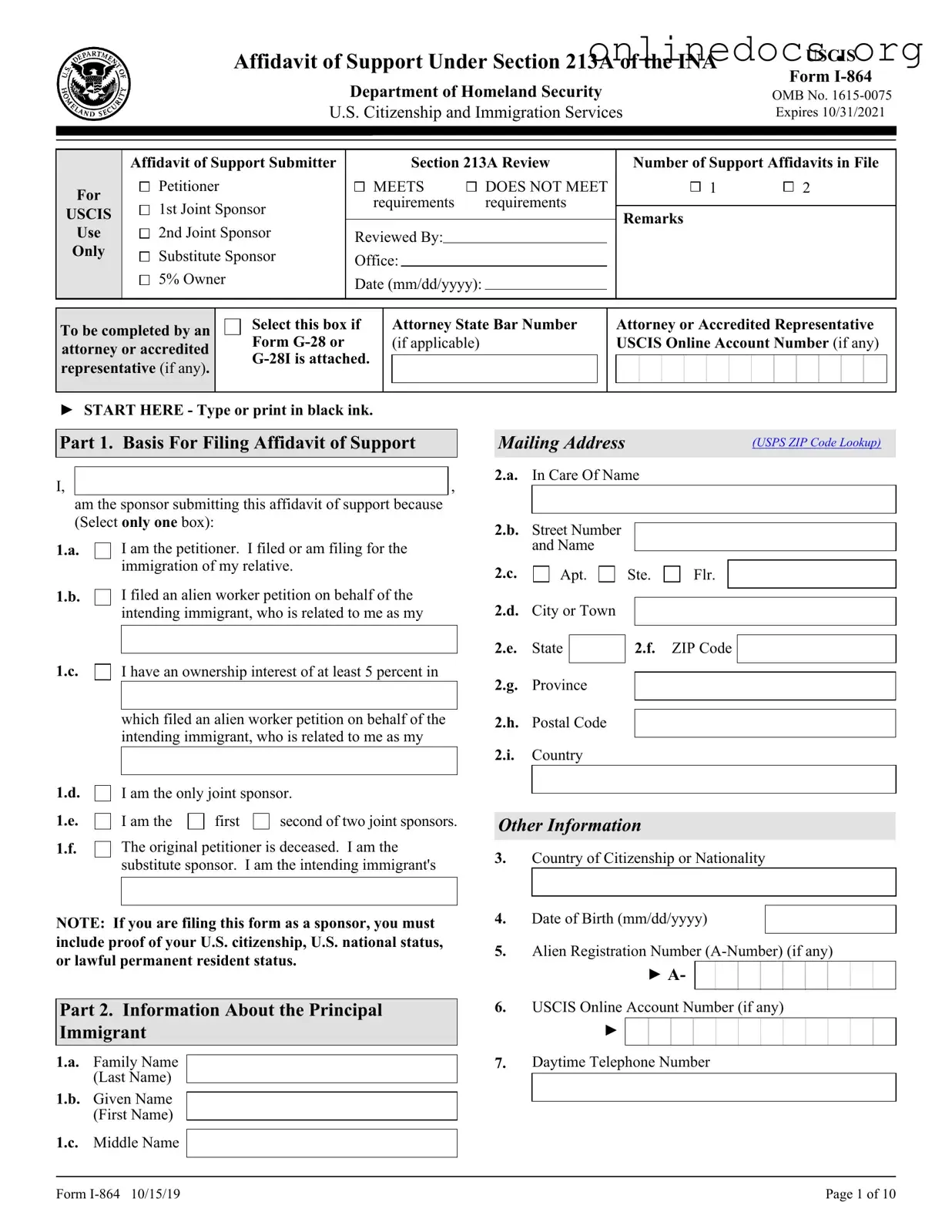

The USCIS I-864 form, known as the Affidavit of Support, is similar to the I-134 form. The I-134 is also an affidavit of support, but it is typically used for non-immigrant visa applicants. Both forms require the sponsor to demonstrate financial ability to support the applicant. However, the I-864 is more comprehensive, as it is designed for immigrants seeking permanent residency, whereas the I-134 serves temporary visitors and may not require as extensive documentation of income and assets.

Another document that shares similarities with the I-864 is the I-864A, which is the Contract Between Sponsor and Household Member. This form is used when a household member’s income is included to meet the financial requirements for the I-864. Both forms aim to ensure that the immigrant will not become a public charge, but the I-864A specifically addresses the contributions of additional household members, thus expanding the financial resources available to the immigrant.

The I-864W, or Intending Immigrant’s Affidavit of Support Exemption, is also related to the I-864. This form is used by certain applicants who are exempt from needing a sponsor's financial support. Like the I-864, it serves to establish financial responsibility, but the I-864W is applicable to individuals who have sufficient means to support themselves without a sponsor’s help, such as those with U.S. citizenship or permanent residency.

Next, the I-130 form, Petition for Alien Relative, shares a connection with the I-864. While the I-130 establishes the relationship between the sponsor and the immigrant, the I-864 ensures that the immigrant will have adequate financial support. Both forms are essential in the immigration process, but they serve different purposes: one focuses on family connections, while the other addresses financial stability.

The N-400, Application for Naturalization, also bears similarities to the I-864 in that it requires the applicant to demonstrate good moral character and financial responsibility. While the N-400 is for individuals seeking citizenship, it involves a review of the applicant's financial history and obligations, similar to how the I-864 assesses the sponsor’s financial ability to support the immigrant.

The I-751, Petition to Remove Conditions on Residence, can be compared to the I-864 in terms of financial accountability. The I-751 is filed by conditional residents to prove their marriage is genuine and ongoing. Like the I-864, it may require evidence of financial support and shared resources, reinforcing the importance of financial stability in the context of immigration status.

The I-864P, Poverty Guidelines, is another document relevant to the I-864. The I-864P provides the income thresholds that sponsors must meet to support their immigrant relatives. While the I-864 is the form used to declare financial support, the I-864P sets the standards for what constitutes sufficient income, making both documents interconnected in the immigration process.

To establish a strong legal foundation for your LLC, it is crucial to complete a precise Operating Agreement that outlines the governance and operational practices. For assistance in drafting your essential Operating Agreement, click here to access a comprehensive set of resources at fillable templates for your Operating Agreement.

Lastly, the Form I-944, Declaration of Self-Sufficiency, is similar in that it assesses the financial situation of the immigrant. The I-944 requires immigrants to provide information about their financial resources, education, and skills to determine their ability to support themselves. While the I-864 focuses on the sponsor's responsibility, the I-944 evaluates the immigrant's potential to be self-sufficient, highlighting the overall financial health of the immigrant's situation.